What is Lending? Is the Lending exchange on Binance reputable?

The birth and development of the Lending Crypto platform has become a trend for the financial world!

What is Lending?

Lending is a form of lending Coin / Token market electronic money . This means that Traders who have idle Coin/Token will lend to borrowers - Borrower for a certain period of time with a pre-committed interest rate. At the end of the loan term, the borrower will return both the principal and interest to the lender.

Currently, exchanges are divided into 2 types:

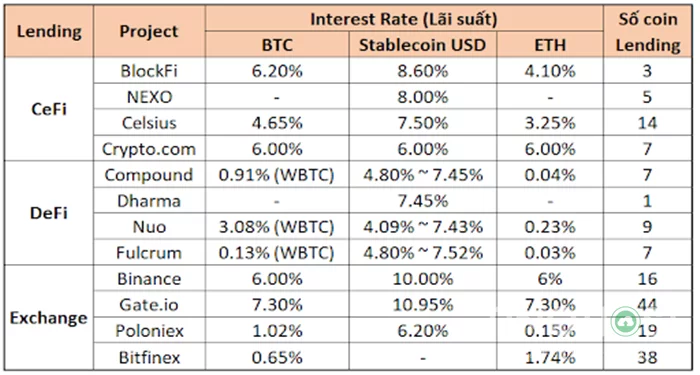

CeFi – Centralized: These are lending platforms that belong to a centralized financial platform. In this type, we can understand as a 3rd party standing between Lender and Borrower's operation control, often accompanied by a trust form. The exchanges under this platform are: Nexo, Celsius, BlockFi, Salt, …

DeFi – Decentralized: Lending platform in decentralized finance will completely eliminate third parties as well as the form of trust. Lending activities will be under the agreement of the lender and the borrower. Decentralized exchanges are: Compound, Aave, InstaDApp, Dharma, Maker, Fulcrum, Constant, Bzx, Nuo, ...

Parameters related to Lending

Interest Rate (Interest Rate)

This is the interest rate when you make a loan of any Crypto coin. This ratio is considered a prerequisite to promote Lender's lending behavior. Moreover, stable coins like ETH , BTC often have lower lending rates than new coins.

Lending Time

The loan period is the time from the beginning until you can get the principal and interest back. Each exchange will have a different lending period. Normally it will be 7 days, 14 days, 28 days, 30 days or 90 days. During the specified period, your lending Coin will be locked and loaned to others. You cannot withdraw your loan before maturity.

Loan assets

Each trading platform will accept many different types of Coins, you need to own the allowed Coins in the Wallet to have enough facilities to lend. Besides, the factor you need to pay attention to is the total value of Locked - Total Value Locked TVL. This is the amount that has been locked into a DeFi protocol. Or to put it another way, xthis is a liquid asset in a cryptocurrency market.

Total Value Locked (TVL)

This is the total amount of lock assets inside the platform. This number will show the level of interest and engagement of users to this platform. The more assets locked inside the platform, the more impact on the price of that coin.

Outstanding advantages of Lending in the cryptocurrency market

For lenders: In Lending, they can take advantage of their idle Coin/Token resources to increase the number of Coins without having to make transactions directly on the market.

For the borrower: this loan can be used as a leverage to maximize the profit with the real small capital of the user by Margin transactions.

Coming to the form of Lending at platforms or exchanges that are provided with many different options for Coin/Token to be loaned/borrowed. Moreover, you can choose the loan/borrowing period that suits your purposes and needs.

The nature of Lending's operation on exchanges

On the exchange, Lending activities usually take place for the purpose of creating funds for Margin services. Traders will borrow an extra part of Coin from the exchange to leverage their trades.

To make a Coin loan, Traders can use two ways as follows:

Method 1: Use Coin in the exchange's reserve wallet

Method 2: Borrow Coin from a guest user at an agreed-upon interest rate.

When Traders want to make margin trades, the floor owner lends them to them. When users can trade, exchange with capital greater than the amount they actually have, through financial leverage, margin trading will occur. In exchanges, Traders can borrow Crypto from the exchange owner or others.

Explore the overview of Lending on Binance exchange

What is Binance Lending?

Binance Lending is a way for users to lend a certain amount of assets such as BNB, USDT , ETC, etc. to the Binance exchange and receive interest back when the loan expires.

About Binance Lending

Annual interest rate: BNB (0.4%), USDT (3.05%), BTC (0.22%)

Loan term: 14 days

Interest payment time: right after maturity

Registration: first come, first served

How to Lending on Binance

Step 1: Open a trading account at the exchange and verify security

First, you access the page http://binance.com

Next, click “Register” to open an account

You fill in the required information: Email , Password => Select "Create account" . At this time, the exchange's system will send a confirmation code to Email , you need to confirm in the correct box as required.

At this point, the account personal area displays "Security Verification" . You conduct security verification through two steps: “Verify phone” and “Verify Google” . To do this, you click on each type to verify.

You proceed to deposit Coin into your account. At this point, you can start making Lending

Step 2: Proceed to deposit Coin into your account

To perform a Coin lending transaction on Binance, you need to deposit Coins into your wallet. For Binance that already has an e-wallet, you can transfer Coins directly from the wallet to your Binance account or use fiat currency to buy Coins.

At the homepage interface, you select "Wallet" => Click "Deposit" and select the deposit method that suits you personally.

Step 3: Start Lending

Right on the homepage, you select "Finance" => select "Binance Earnings" . Here, you can choose flexible Lending or fixed Lending.

Next, you choose the type of Coin / Token you want to Lending.

Select the term , then click the "Transfer" button to complete.

To see the full list of Coins/Token Lending, you can visit the "See More" section.

For Borrowers, you can borrow Coin/Token on Binance, to do so, go to “Finance” => Select “ Cryptocurrency lending” . Here, you can select the Coin you want to borrow, enter the amount and choose the type of collateral Coin, loan term. The system will automatically calculate the loan interest for you. You click on "Start borrowing now" to complete.

Review of Binance Lending

Advantages

Safety: Binance is known to own a SAFU fund that insures user assets. Therefore, you can feel secure when participating in Binance Lending.

Simple and friendly: Binance has a beautiful, user-friendly interface. The operations of Binance Lending are very easy to do. At the end of the loan term, both principal and interest are immediately paid to the user.

Possessing a large volume of Lending

Optimizing profits for users, Binance Lending takes advantage of idle assets , enlisting to earn more profits.

Defect

Interest rates are still limited, there is no high competition. The interest rate of Binance Lending compared to other lending platforms is quite low.

The loan term is only from 14 days, quite short and no flexibility. Limit investment time during the loan period

Lending assets are not diversified

Support few Coin Lending coins. As of now, Binance Lending only has USDT, BNB, BTC and BUSD.

Through the above article, you must have a clear answer about what is Lending? with issues related to this topic. Hopefully, this useful knowledge can help you come to the right choice for yourself. Good luck!

WARNING: This is an information sharing article, not a call to invest, you must be responsible for your own decisions. Investing in financial products always involves a lot of risks, so you need to consider carefully before making a final decision. Wish you wise and sober to make the right investment decisions!

FAQs about Lending

Where does Lending service get money to pay borrowers?

Working similar to a bank, Lending's exchanges will mobilize users' Coins, transfer them to people who need to borrow or make other profitable investments. Then, they will use the profits to pay interest to the Lenders.

Is Lending service really reputable?

In the Lending service, it can be said that there are both outstanding opportunities and uncontrollable risks. The risk can occur when the lending Coins plummet in price within the term, which makes the lenders unable to recover and cut losses. Besides, Lending is a way for Traders to earn extra income when they intend to keep their assets in the long term. In short, the Lending service is reputable and you should experience it.

Does anyone who does the Lending model also succeed?

Not everyone who does Lending is successful. This model really pays off when the price of Crypto Lending is blown and grows continuously. It only really appears when there is a large enough and sustained buying force.

What are the risks that can arise from the Lending model?

The mind of the floor owner: If the owner of the floor invests seriously, it's okay, if they have the intention to come from the beginning, it will cause you a lot of trouble.

Exchange rate fluctuations: When the value of the Base currency declines for a long time, it can cause imbalance in liquidity. This will seriously affect the financial structure and Lending model.

It can be said that Lending is not a playground for those looking for luck. You need to have knowledge and understanding of this field to be able to invest profitably.

- What is Shiba Inu Coin? Where to buy reputable Shiba Inu Coin now?

- What are Splinterlands? Overview of the Splinterlands project

- What is Coinbase Pro exchange? Learn more about Coinbase Pro exchange

- What is Play to Earn? Find out about the Play to Earn 2021 trend

- What is Poloniex floor? Instructions for trading on the Poloniex exchange